- 3297 East Oakland Park Blvd Fort Lauderdale, FL 33308

- quote@eadvisorpro.com

- +1 800-891-0515

About Financial Planning

The Financial Plan You Ever Need

We believe everyone, regardless of how much money they have, can take control of their financial future and make a plan to reach their goals.

What is Financial Planning?

Financial planning helps you understand where you are today and create a roadmap to get you where you want to be. Planning is personalized to you—whether you’re saving for a single goal, like retirement, or need comprehensive planning and wealth management.

- Discover your goals

- Consider all aspects of your financial life

- Identify action steps

- Create an investment strategy tailored to your goals

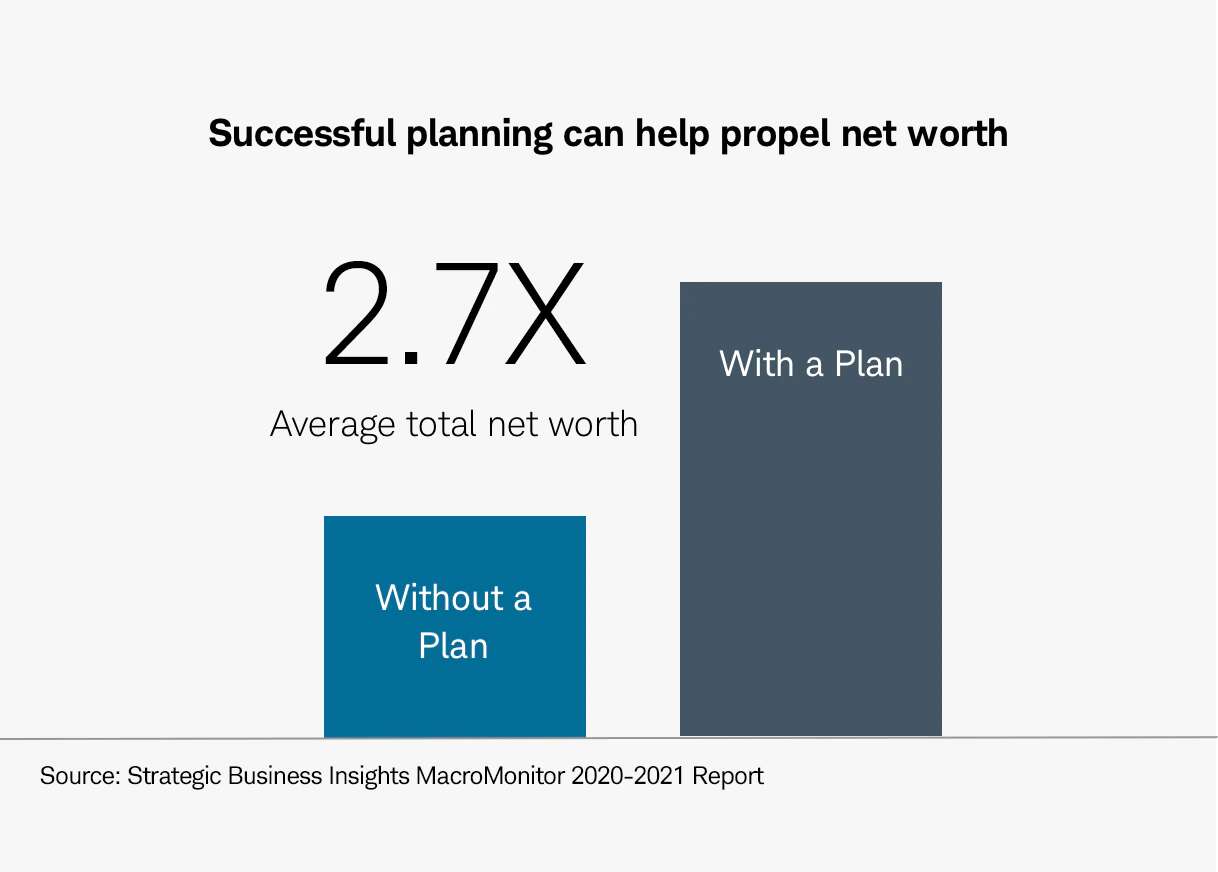

Why is Financial Planning important?

Financial planning helps you take control of your future:

- Feel more confident about reaching your financial goals

- Save for milestones like college and retirement

- Build an investment portfolio tailored to your goals

- Know where you want to go and how to stay on track

Our Partners

Get Insured By The Best Providers

Trust

Integrity

Expertise

Reliable

We've got answers

Frequently Asked Questions

Financial Planning

1.What is monetary preparation?

Monetary arranging is a powerful cycle where clients work with an expert to distinguish objectives, analyze assets, and create a guide to accomplish their monetary targets. Monetary Planning implies significantly more than simply contributing. It can give solace in knowing how to remain monetarily on target all through many phases of life.

3.What would it be a good idea for me to search for in a monetary organizer?

Become familiar with requesting from their involvement with any area you are focusing on (i.e., school arranging, resigning, home buy, legacy, and so forth) An organizer is acting to YOUR greatest advantage, not their own or the organization they work for.

5.What sort of data do I need to give?

The quantifiable things are what you own, what you owe, and what you procure. In discussions with your monetary organizer, the person will likewise assist you with uncovering the subjective factors, for example, your set of experiences with cash and your fundamental beliefs, as they assist you with defining reachable objectives to pursue.

7.For what reason do I have to think about protection with my monetary arrangement?

A major piece of a successful arrangement is becoming mindful of and tending to the dangers that might lie ahead. Protection safeguards you and your friends and family against horrendous occasions. Health care coverage, extra security, inability protection, auto and home protection can be in every way viewed in a monetary arrangement. A monetary organizer can dissect existing arrangements for their expense viability and advantages to you and your loved ones.

9.How might I pick a decent monetary organizer?

Pick a monetary organizer who has experience managing clients in comparable conditions to yours. You'll likewise need to ensure that the monetary organizer has your wellbeing as a primary concern, and that the person in question isn't selling you items that are not fit to your requirements. Interview imminent monetary organizers and get some information about qualifications, the executives procedures, and history of execution.

2.For what reason would it be advisable for me to make a monetary arrangement?

The aphorism goes "On the off chance that you don't have any idea where you're going, how might you know when you arrive?" The arranging system recognizes what is reachable given your assets, however now and then the thing is being disregarded. Preferably, it cements that your objectives are actually your objectives and helps balance the draw and push of the present requirements, needs, and wishes with those of things to come.

4.What amount would it be a good idea for me to save?

The response relies upon many factors like your age, conditions, objectives, and values. On the off chance that saving isn't as of now a propensity, the significant thing is to begin at a sensible level and afterward endeavor to build that level whenever the situation allows. Continuously ensure you are contributing to the point of getting any organization matching commitments to retirement plans. Try not to overlook that remuneration.

6.What should a monetary arrangement incorporate?

A monetary arrangement ought to incorporate a survey of your objectives and targets, total assets, income, speculation portfolio, protection, and expenses. These are the structure blocks used to make projections and to plan an arrangement for executing systems to accomplish your objectives. It can likewise incorporate probabilities of achievement for meeting your objectives to guarantee the true serenity for which we as a whole endeavor.

8.What would it be a good idea for me to do once I have an arrangement?

Remain effectively involved. Executing on your monetary arrangement is a group approach. Assuming you have somebody dealing with your ventures, they ought to execute on your speculation system. There will be different things like overseeing income, opening records, and saving or spending at the "arranged" levels that will require your dynamic contribution. Correspondence and circle back to your organizer will assist you with acclimating to the knocks (all over) in your guide to keep up with the way of life you pick.

10.What are the best monetary administration organizations?

The way to fruitful monetary arranging is observing a genuine and educated monetary guide that has your interests on the most fundamental level. Any monetary administration organization might conceivably utilize such a consultant. It's extraordinary to agree with an organization that has a decent history of client assistance, positive returns, and open expense structure, yet don't zero in on this to an extreme. Zero in on finding an amazing counsel regardless of anything else.

Request a Quote

Get auto insurance online – instantly

Let us guide you to a better future.

You have goals, but no financial planning. Now that sounds risky. Let us be your guide so you can sail through life smoothly. With better financial planning, you can have increased savings, a better standard of life, and most of all, you will have peace of mind.

- Get a quote instantly from our insurance experts

- We shop around with over 100 providers to find the right match

- Secure your future with the best rated policies

- Get more than just insurance with eAdvisorPro